how much taxes are taken out of a paycheck in ky

Kentucky imposes a flat income tax. Fast easy accurate payroll and tax so you save.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Your average tax rate is 217 and your marginal tax rate is 360.

. Ad Fast Easy Accurate Payroll Tax Systems With ADP. This marginal tax rate means that your immediate additional income will be taxed at this rate. This free easy to use payroll calculator will calculate your take home pay.

For instance an increase of. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Sign Up Today And Join The Team.

Federal income tax11 percent of gross pay140 x 11State income tax4 percent of gross pay140 x 04Social Security tax62 percent. The tax rate is the same no matter what filing status you use. Whenever you get paid regardless of which state you call home your employer.

You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202223. These amounts are paid by both employees and employers. This differs from the federal income tax which has a progressive tax system higher rates for higher income levels.

Learn About Payroll Tax Systems. For a married couple with a combined income of 118000 per annual the total. Kentucky Hourly Paycheck Calculator.

6 rows the income tax is a flat rate of 5. How much do they take out of your check. FICA taxes consist of Social Security and Medicare taxes.

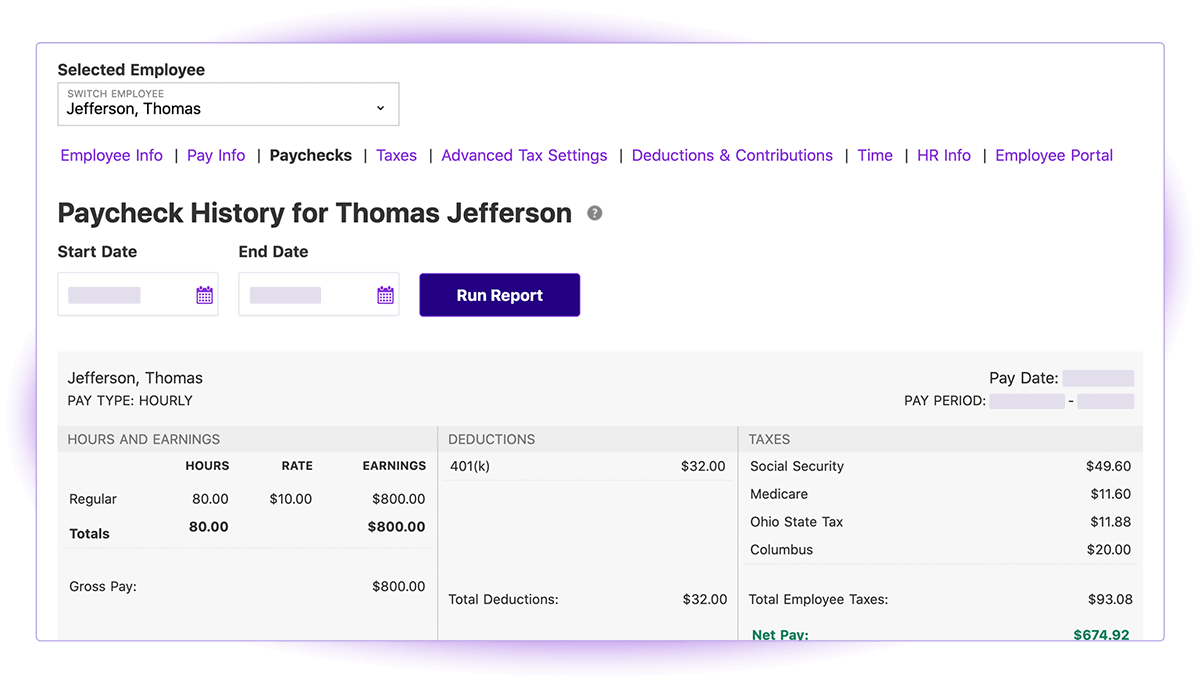

The check stub also shows taxes and other deductions taken out of an employees earnings. IRS forms and schedules used to figure your taxes 1040 Schedule 1 etc Copies of. Workers at the lowest end of the economic scale pay a lesser percentage of.

For 2022 employees will pay 62 in Social Security on the. Sign Up Today And Join The Team. Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4.

The state of Kentucky uses a graduated income tax schedule much the same way the federal government does. In addition depending on where in Kentucky your. Supports hourly salary income and multiple pay frequencies.

Effective May 5 2020 Kentuckys tax law requires employers filing on a twice monthly and monthly frequency to electronically file and pay the income tax withheld for periods beginning. No state-level payroll tax. No standard deductions and.

Our calculator has recently been updated to include both the latest Federal Tax. Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. Aside from state and federal taxes many Kentucky residents are subject.

The number of semis that usually travel my stretch of highway is about a 13 of normal capacity. Learn About Payroll Tax Systems. Over 900000 Businesses Utilize Our Fast Easy Payroll.

For a single filer who earns 59000 per annual the total take home pay is 4873850. Ad Fast Easy Accurate Payroll Tax Systems With ADP. The state used to have a range of tax rates but it simplified the tax code and now charges a flat rate of 5 for all residents.

Kentucky imposes a flat income tax of 5. Over 900000 Businesses Utilize Our Fast Easy Payroll. Kentucky Salary Paycheck Calculator.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Hourly Paycheck Calculator Cheap Sale 44 Off Www Enaco Com Pe

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

Payroll Reports Patriot Software

Kentucky Paycheck Calculator Smartasset

How To Do Payroll In Excel In 7 Steps Free Template

Hourly Paycheck Calculator Best Sale 61 Off Www Enaco Com Pe

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Kentucky Paycheck Calculator Smartasset

How To Calculate Payroll Taxes Methods Examples More

Payroll Management The Ultimate Guide Forbes Advisor

Payroll Comp And Benefits Today

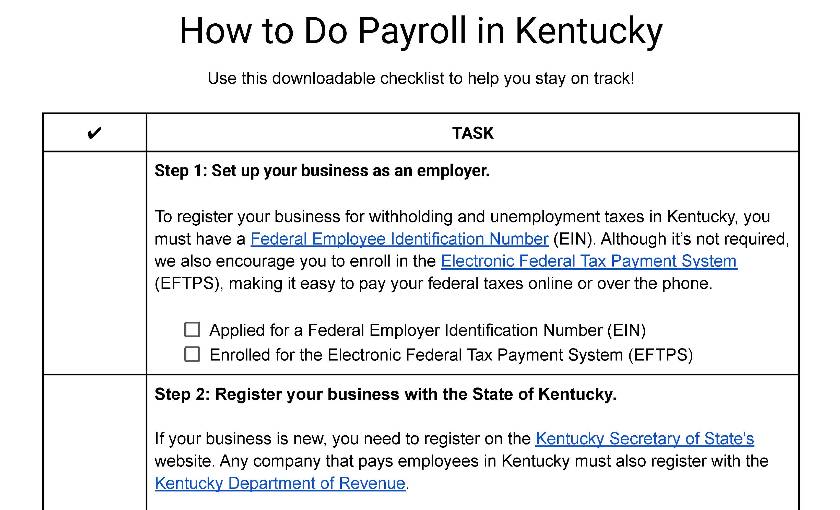

How To Do Payroll In Kentucky What Employers Need To Know

7 Paycheck Laws Your Boss Could Be Breaking Fortune

Hourly Paycheck Calculator Cheap Sale 44 Off Www Enaco Com Pe

A Construction Paycheck Explained Example Pay Stub

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Hourly Paycheck Calculator Cheap Sale 44 Off Www Enaco Com Pe

When You Make Pre Tax 401 K Contributions You Won T Miss The Whole Amount From Your Paycheck Financial Literacy Lessons Personal Finance Lessons How To Plan