iowa capital gains tax farmland

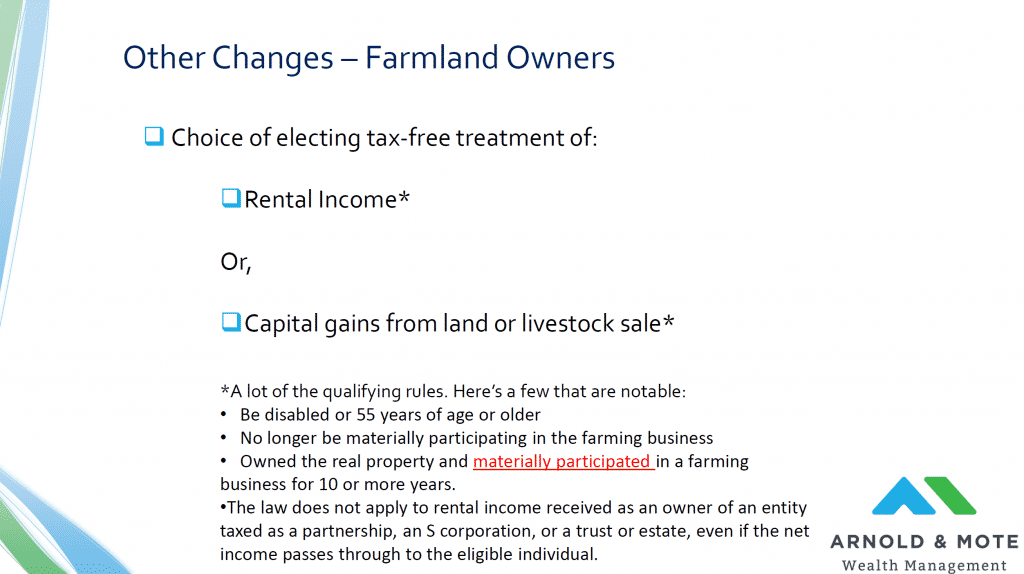

Iowas capital gains tax is waived if. They can take a lifetime election to exclude the net capital gains from the sale of their farmland.

Iowa Capital Gain Exclusion Inapplicable To Sale Of Partnership Interest Center For Agricultural Law And Taxation

The legislative services agency estimated the farm capital gains tax exemption will cost the state an estimated 72 million in fiscal year.

. Some or all net capital gain may be taxed at 0 if your taxable income is less than 80000. What is an estate tax on the sale of farmland. Iowa Code section 422721 Iowa Administrative Rule 701-4038422 Various federal statutes rules and court cases as applicable to Iowa.

At the 22 income tax bracket the federal capital gain tax rate is 15. Numerous cases and policy letters in Iowa tax. Kim Reynolds signed a 39 flat tax on March 1 which will roll back taxes for many farmers but.

Iowa has a unique state tax break for a limited set of capital gains. Capital gains taxes are due when farm or ranch land buildings breeding livestock and timber are sold. Ad Read this guide to learn ways to avoid running out of money in retirement.

Iowas capital gains tax is linked to the individuals income tax rate. What Iowas new flat tax means to farmers Farm Progress 2 days ago Mar 18 2022 Iowa Gov. - Law info 1 week ago Jun 30 2022 The tax rate on most net capital gain is no higher than 15 for most individuals.

However the actual rates are lower because iowa has a unique deduction for federal income taxes from. When a landowner dies the basis is automatically reset to the current fair. The federal capital gains tax is currently fixed at 15 percent regardless of income.

The 2018 tax reform legislation set the top individual tax rate. This rate applies to income over 78435. A taxpayer may deduct 50 of the net capital gain from the sale of exchange of employer securities of an Iowa corporation to a qualified Iowa ESOP.

Some or all net capital gain. Kim Reynolds signed a 39 flat tax on March 1. To be eligible the Iowa ESOP must.

How much are capital gains taxes on a farm. Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet. Iowa Capital Gains Tax Farmland.

The tax rate on most net capital gain is no higher than 15 for most individuals. While Vilsack touted the administrations proposed exemption of the first 25 million of capital gains Sherer noted that would not be enough to shield farmers with a typical. The tax is owed on the amount that the property increased in value since it.

Compare the pros and cons and review tax consequences of farm sales. How Much Is Capital Gains Tax In Iowa. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years.

Learn ways dividends can help generate income in this free retirement investment guide. The top individual income tax rate in Iowa in 2022 is 853 percent.

Iowa Legislature Sends Significant Tax Bill To The Governor Center For Agricultural Law And Taxation

Understanding Section 2032a Special Land Valuation Under New Tax Plans

State Taxes On Capital Gains Center On Budget And Policy Priorities

Struggle Over Tax Break For Inherited Farmland Churns Below Surface In Reconciliation Bill Missouri Independent

Struggle Over Tax Break For Inherited Farmland Churns Below Surface In Reconciliation Bill Iowa Capital Dispatch

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Capital Gains Tax Iowa Landowner Options

What Property Qualifies For 1031 Exchange Cla Cliftonlarsonallen

Farmland Market Outlook For 2022 From An Iowa Auctioneer

Struggle Over Tax Break For Inherited Farmland Churns Below Surface In Reconciliation Bill Iowa Capital Dispatch

Iowa Governor Signs Tax Reform Into Law Center For Agricultural Law And Taxation

Capital Gains Tax Iowa Landowner Options

Vilsack Says 98 9 Of Farmers Won T Be Impacted By Biden S Tax Plan Tax Experts And Economists Still Disagree Agweb

Family Farm Legacy Threatened By Proposed Tax Increase

2021 Iowa Legislative Session Ends With Flurry Of New Tax Rules

Iowa Governor Signs Tax Reform Into Law Center For Agricultural Law And Taxation

When Do You Need A Farmland Appraisal Iowa Land Company Blog